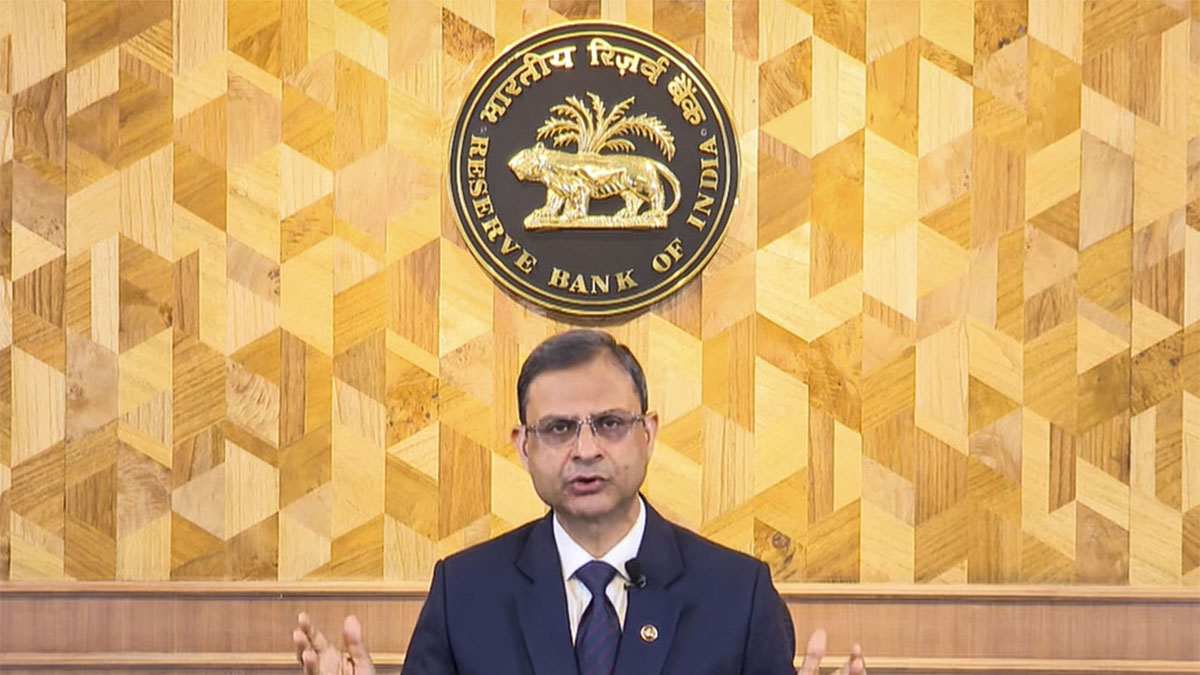

In a major move aimed at reviving economic momentum, the Reserve Bank of India (RBI) has cut the repo rate by 50 basis points to 5.5% during its June 2025 Monetary Policy Committee (MPC) meeting. Additionally, the central bank slashed the Cash Reserve Ratio (CRR) by 100 basis points to 3%, injecting ₹2.5 lakh crore of liquidity into the banking system.

This marks a cumulative 100 basis points cut in the policy rate over just four months (25 bps in February, 25 bps in April, and now 50 bps in June), signaling a clear pivot from inflation control toward pro-growth policies. Notably, the RBI has also changed its policy stance from ‘accommodative’ to ‘neutral’, giving itself greater flexibility in future decisions.

Economists React to RBI’s Bold Moves

Ranen Banerjee, Partner at PwC India, said:

“This dual move—rate cut and CRR easing—will provide a significant boost to consumption, especially with income tax cuts also kicking in from FY26. The move unlocks another engine for India’s growth.”

Rahul Goswami, CIO of Franklin Templeton, noted:

“The 50 bps cut was more aggressive than expected and underscores a decisive tilt toward supporting economic growth amid subdued manufacturing and global trade headwinds.”

Radhika Rao, Senior Economist at DBS Bank, said:

“This is a double-barreled policy action. The RBI is capitalising on a window of low inflation to frontload easing, making space for more action if growth weakens again.”

Upasna Bhardwaj, Chief Economist at Kotak Mahindra Bank, commented:

“A sharper-than-expected cut alongside a neutral stance signals that future policy will be data-driven. The CRR cut will help maintain smooth monetary transmission.”

Industry Cheers Policy Support

Hemant Jain, President of PHDCCI, praised the decision:

“It’s a commendable move that supports growth while acknowledging external uncertainties. India’s macroeconomic fundamentals remain resilient.”

Venkatram Mamillapalle, CEO & MD, Renault India, called it timely:

“This decision, along with the CRR reduction, boosts liquidity and lowers borrowing costs, which will directly benefit sectors like automotive through better financing access.”

Key Takeaways:

- Repo rate cut by 50 bps to 5.5%

- CRR cut by 100 bps to 3%

- Policy stance changed from ‘accommodative’ to ‘neutral’

- Cumulative 100 bps cut in repo rate since Feb 2025

- CPI inflation forecast lowered to 3.7% for FY26

- Liquidity boost of ₹2.5 lakh crore expected from CRR reduction

Outlook

With private consumption expected to strengthen, global FDI inflows holding steady, and inflation under control, the RBI’s latest policy measures set the stage for accelerated economic recovery. However, analysts caution that future rate moves will likely depend on inflation trajectory and geopolitical risks.

)

Bank nifty kitna up jayega rapo rate cut se