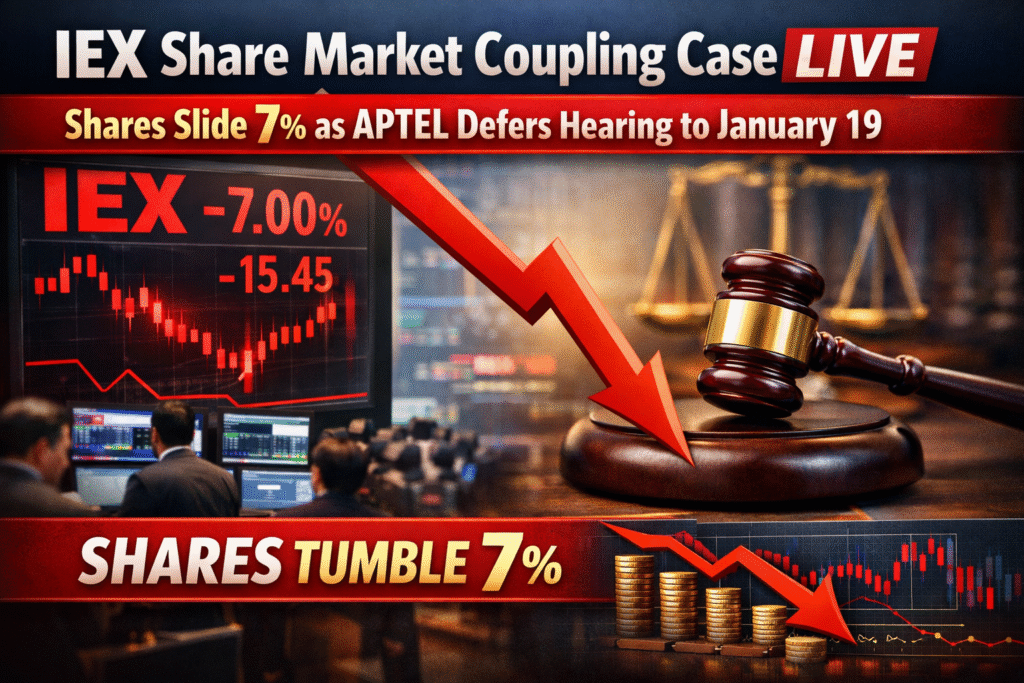

New Delhi: The Electricity Appellate Tribunal (APTEL) has postponed the hearing in the high-profile Indian Energy Exchange (IEX) vs Central Electricity Regulatory Commission (CERC) market coupling case to January 19. The case relates to CERC’s July 2025 directive on day-ahead market (DAM) coupling, which has led to sharp volatility in IEX’s share price.

IEX Share Hearing Concludes for the Day

APTEL concluded the proceedings after hearing IEX’s petition seeking withdrawal of CERC’s July 2025 decision on DAM market coupling. During the hearing, the tribunal sought clarification from CERC on whether it intends to withdraw the directive. However, no final clarity emerged by the end of the session.

CERC Clarifies Status of July 2025 Decision

Ahead of the hearing, CERC issued a circular stating that its July 2025 communication should be treated as a “direction” rather than a formal regulatory order. This clarification became a key point of discussion during the tribunal proceedings.

IEX Challenges CERC’s Direction

In its petition, IEX argued that the CERC’s market coupling direction is arbitrary and violates the principles of natural justice. The power exchange maintained that implementing market coupling would result in a loss of market share for IEX without delivering any meaningful benefits to the electricity market.

CERC Open to Withdrawing the Direction

Earlier, on January 6, CERC’s counsel informed APTEL that the regulator is prepared to take instructions from the tribunal regarding the withdrawal of its July 2025 direction. Following this submission, both parties requested additional time.

Initially, APTEL had scheduled January 9 as the next date of hearing and observed that the case could be closed if CERC formally conveyed its intention to withdraw the direction. The matter has now been listed for January 19.

Stock Volatility and Insider Trading Concerns

The July 2025 market coupling announcement triggered a sharp fall in IEX shares, with the stock declining nearly 7%. IEX has also raised concerns related to possible insider trading, citing SEBI regulations.

On this issue, APTEL stated that it expects CERC to function independently and remain above any suspicion. CERC, in response, said it would examine the matter and take appropriate action if any irregularities are found to prevent a recurrence.

IEX SHARE PRICE

OPEN: 150.09

HIGH: 160.27

LOW: 138.27

What to Watch Next

The upcoming January 19 hearing will be crucial, as a potential withdrawal of the CERC direction could bring an end to the legal dispute and reduce uncertainty surrounding IEX’s business model and stock performance.

also see